App Features

Silicon Interest Accounts (SIAs) is registered under the Securities Act of 1933 and may be offered or sold in the United States, to U.S. persons, for the account or benefit of a U.S. person or in any jurisdiction in which such offer would be prohibited.

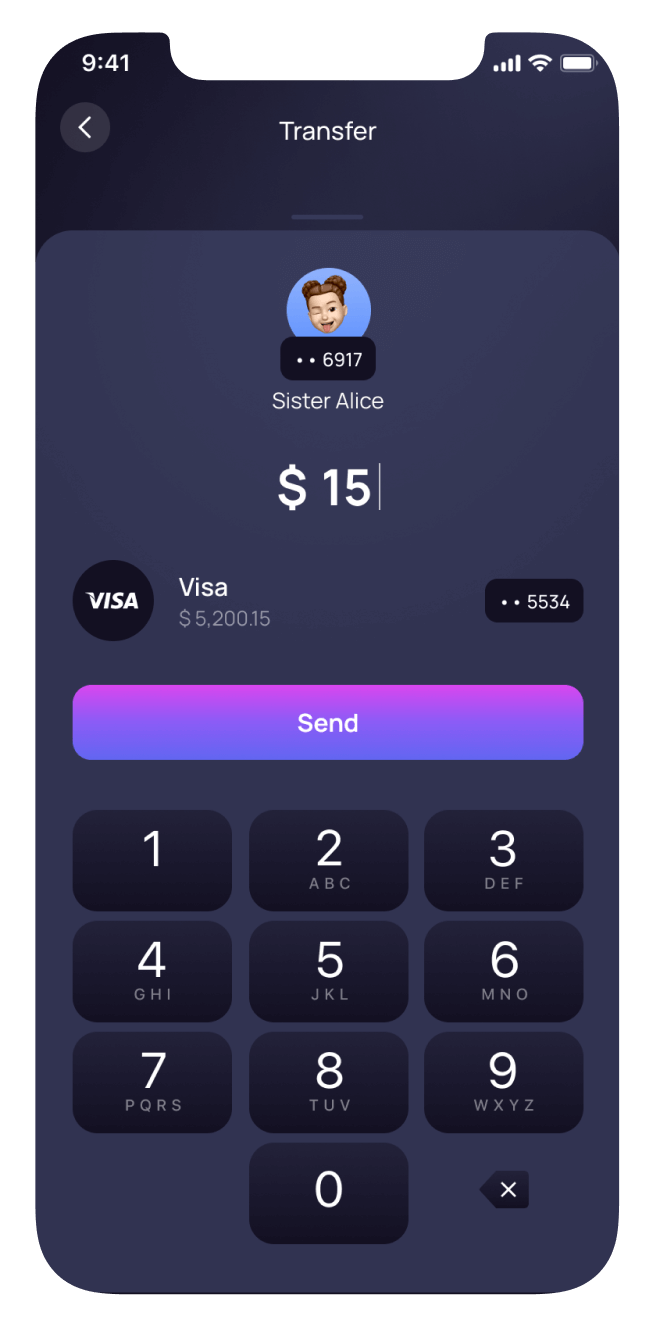

Easy Payments

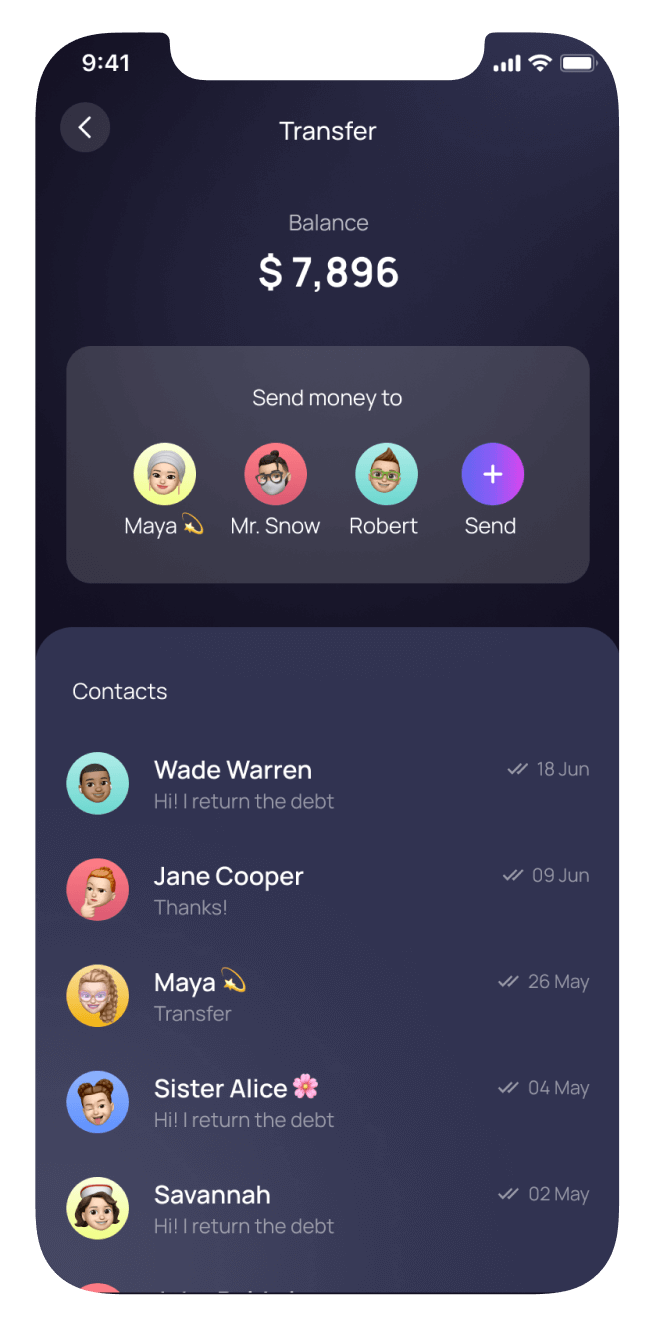

Provides Card-to-Card transfer between people in your contacts

Data Security

Maximum encryption to protect your personal information

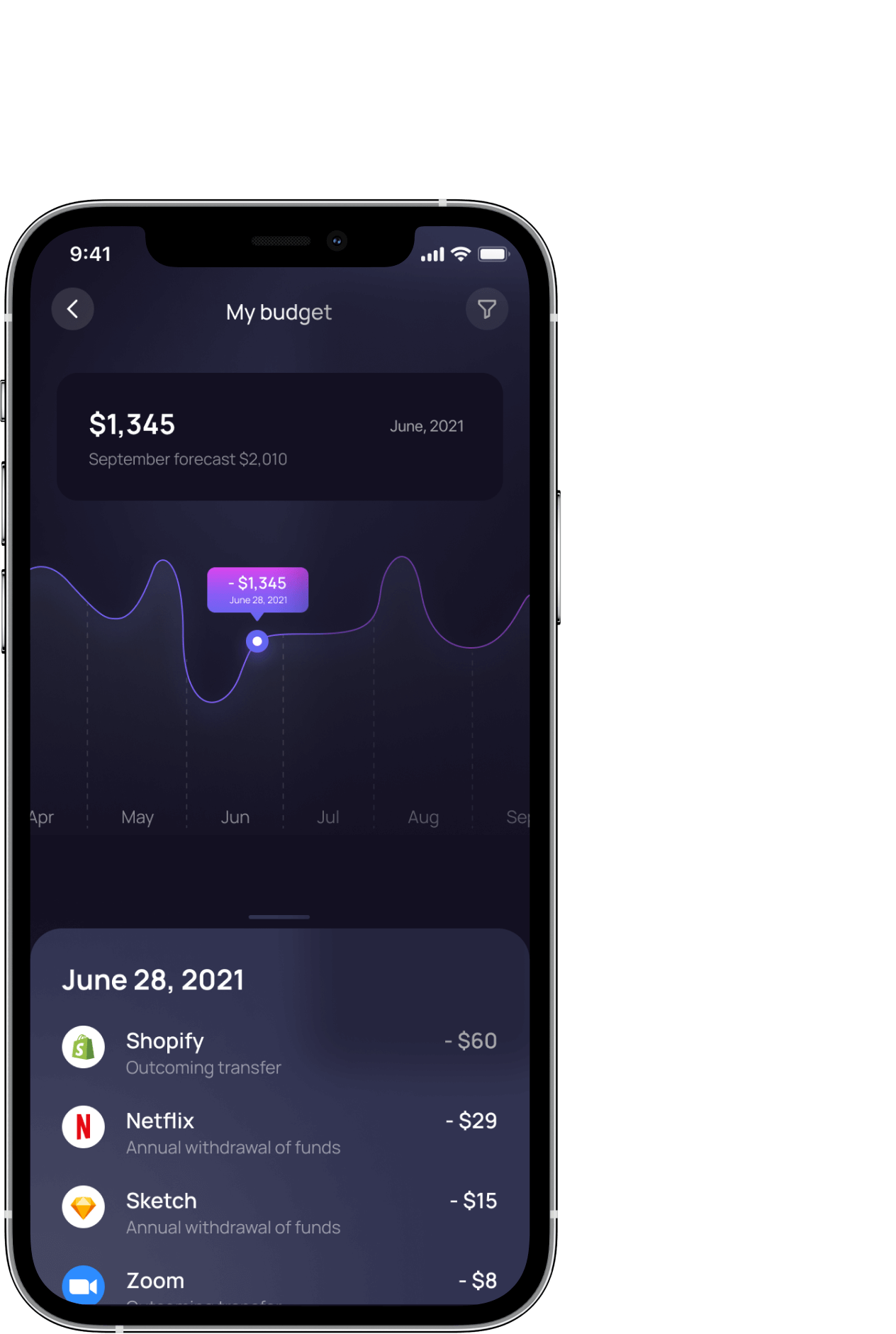

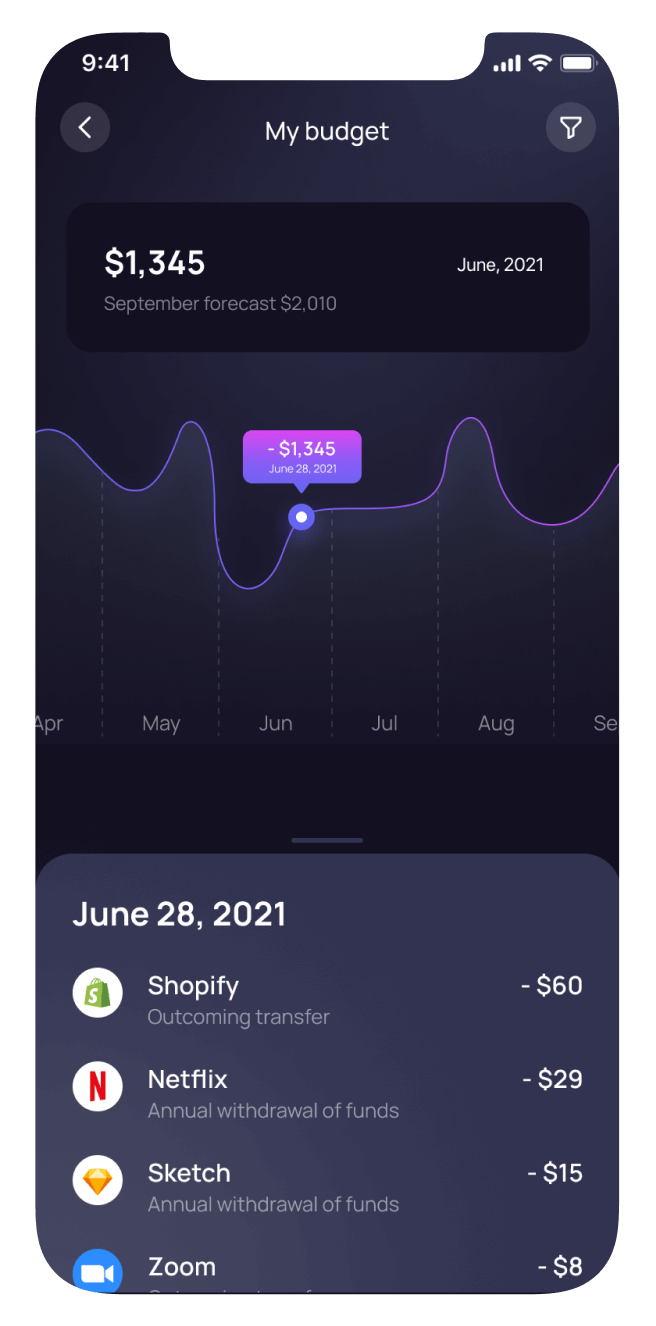

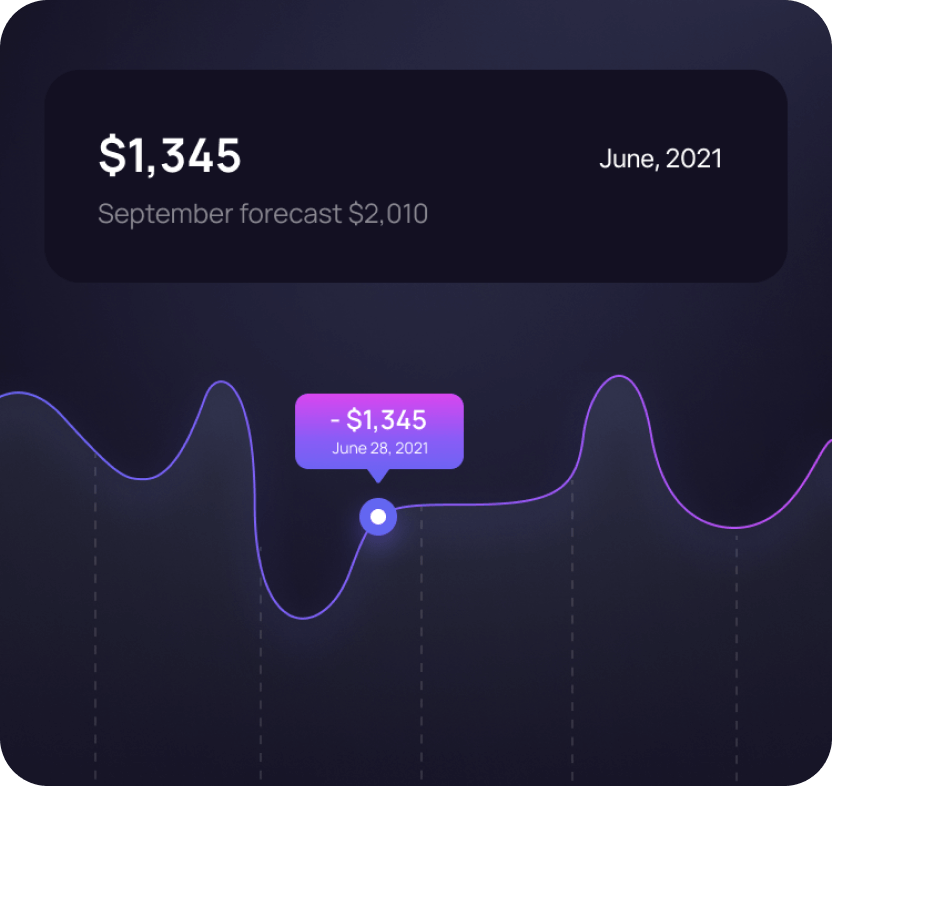

Cost Statistics

Real time personal finance tracking

Support 24/7

Contact us anytime, our support team will try their best to solve your problems

Regular Cashback

Cash back on any purchases £500 or more, rates may vary from 1% to 5%

Top Standards

We have high demands on our team, we ensure customers have the best user experience with Silicon Tracking

How Does It Work?

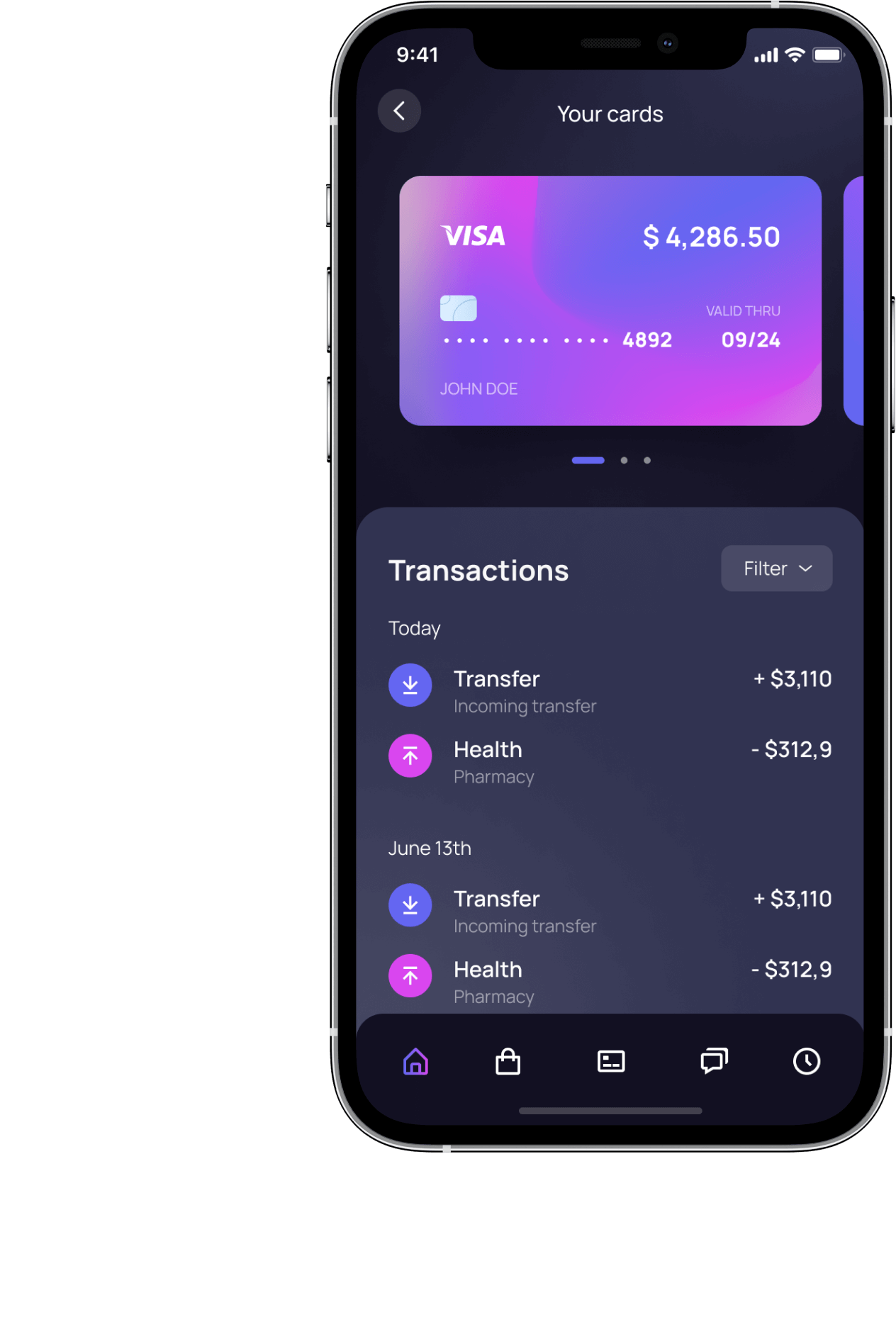

Advanced Budget Management

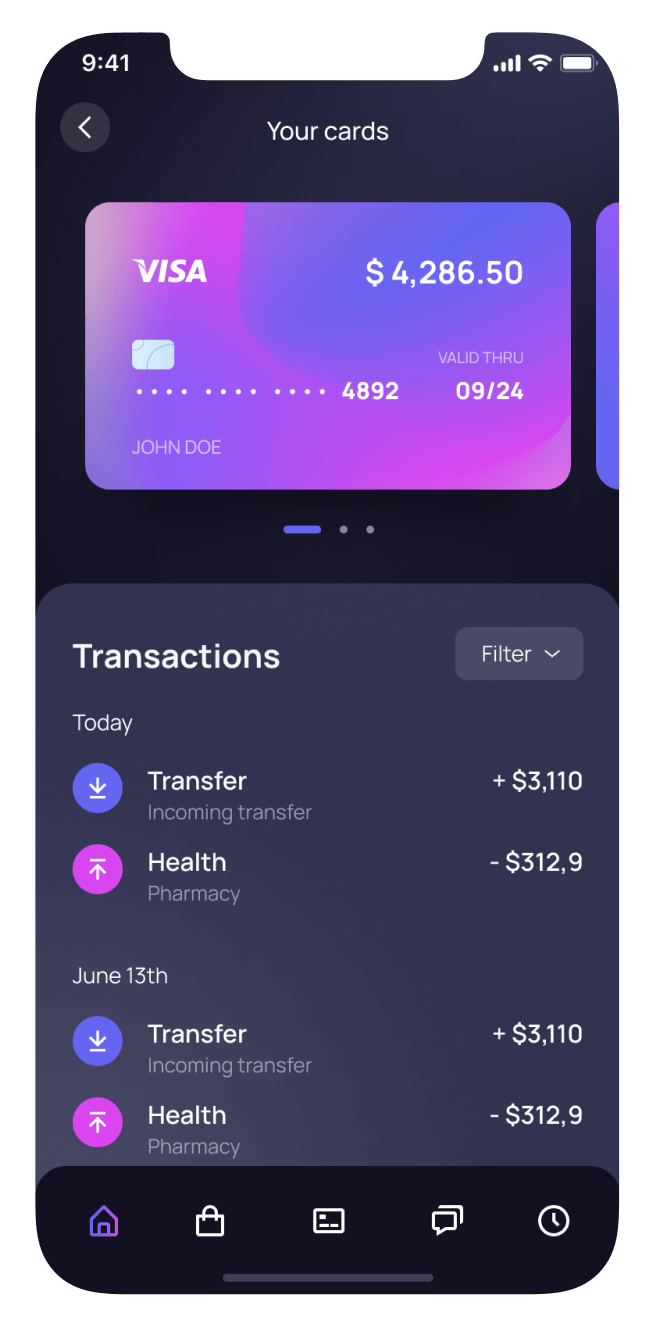

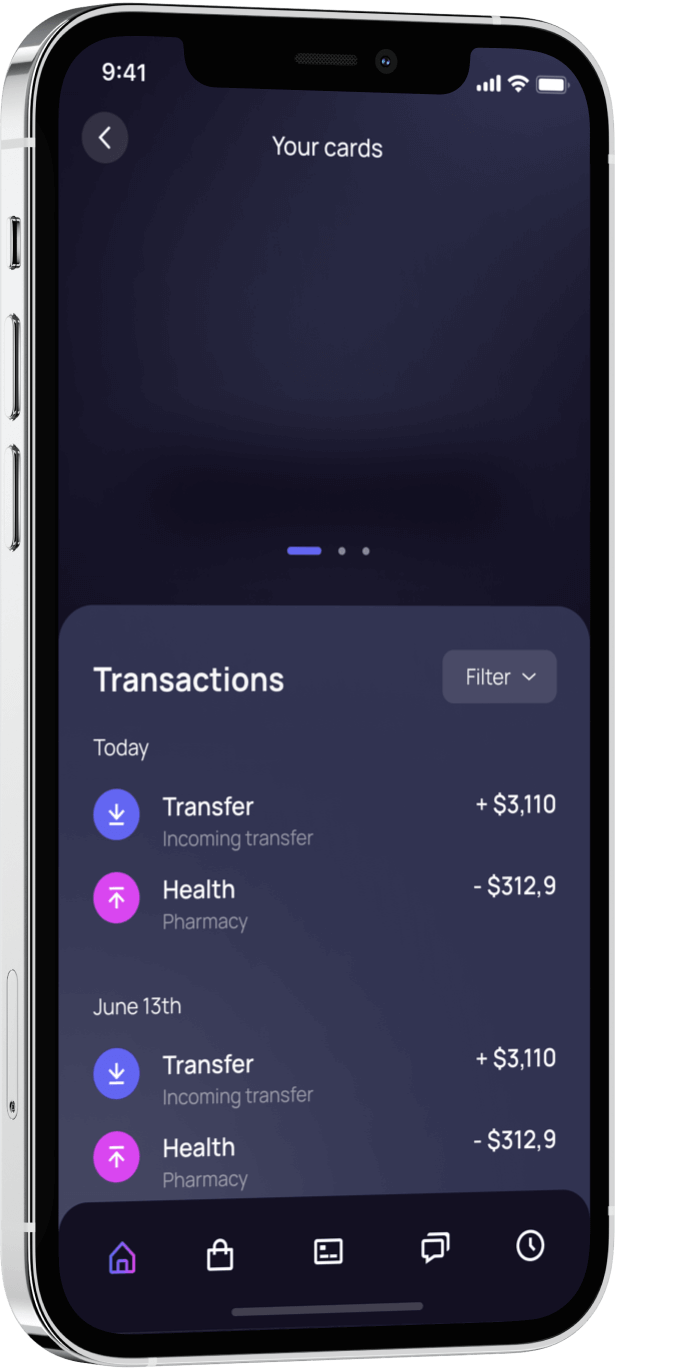

Latest Transaction History

Transfers to people from your contact list

Card-to-Card Transfers

Make your money transfersimple andclear

- Real time tracking data

- No commission on transactions

- Manage payments and transactions online

Receive payments fromanyone,anywhere,anytime

Manage your payments online. Our APIs allows for real time payment processing and tracking.

Process payments with those in your contacts or anyone given their bank details

Any questions?

Check out the FAQs

Still have unanswered questions and need to get in touch? Visit our support page

Still have questions?

Call UsStill have questions?

Chat with UsIf an app has multiple possible use cases with different data collection practices, the privacy information section should include the practices of all of them, and how they are used. For example, if an app has different data collection practices for a free version and a paid version of the app, it should report all of the data types collected for both cases. There may also be differences between child-only and adult versions of an app, differences between data collection in different regions and other differences depending on your use of the app. The app developer’s privacy policy may provide more detail about how its data collection practices may vary in different cases.

If a developer asks for information from you inside the app, they still need to disclose that data in the privacy information section. In limited cases, developers may choose not to disclose a data type that is collected, if the collection is infrequent and is not part of the app’s primary functionality, it is collected in a way that is clear in the experience what data is collected, your account information or name is prominently displayed and you make a clear choice to share the information. In addition, apps on the App Store do not need to declare information that is only collected by Apple, such as App Analytics or payment information used for in-app purchases. Apps also don’t need to declare data if they are facilitating regulated financial services and the collection meets certain conditions or when collection is subject to an informed consent form as part of a health research study that has been reviewed by an ethics review board.

1. Login to the app

2. Click on the specific account

3. Click the Statements & Documents link from the left-hand menu

4. The Statements & Documents page will display

5. Click Go next to the statement you wish to print, your statement will open in a separate window. - SAVE THIS DOCUMENT

1. Click Add Transaction

2. Enter the date of the next occurrence of the transaction

3. If it's a repeating transaction, select the frequency in the drop-down menu below the calendar

4. Your transaction will now appear at the top of your register in gray. It will not yet affect your budget

5. When the date of the next occurrence comes, the transaction will appear in bold in your register, waiting for you to approve it (we want to make sure it actually happened as planned!)

If you notice anything strange on your account, or you accidentally make a payment to the wrong account, get in touch with your bank as soon as possible

Some banks offer instant card freezing, where you can block your card in you app without having to call or visit a branch. Contact your bank to check if they offer this additional security feature

1. Click to "Forgot your password" in the sign in page

2. Enter your email address, we will send you a confirmation email to your inbox immediately after

3. Follow the email sent to change your password